📊 Fundamentals first:

- Short-term: The copper market is turbulent—marked by sharp price spikes, crashes, and global shifts in stock levels.

- Medium-term: Despite forecasted surpluses from ICSG, technology innovations and steady demand (especially from China and green sectors) may underpin prices.

- U.S. risk factor: The tariffs remain a major wildcard, likely restructuring trade flows, increasing domestic input costs, and distorting global price differentials.

📈 Now the Chart:

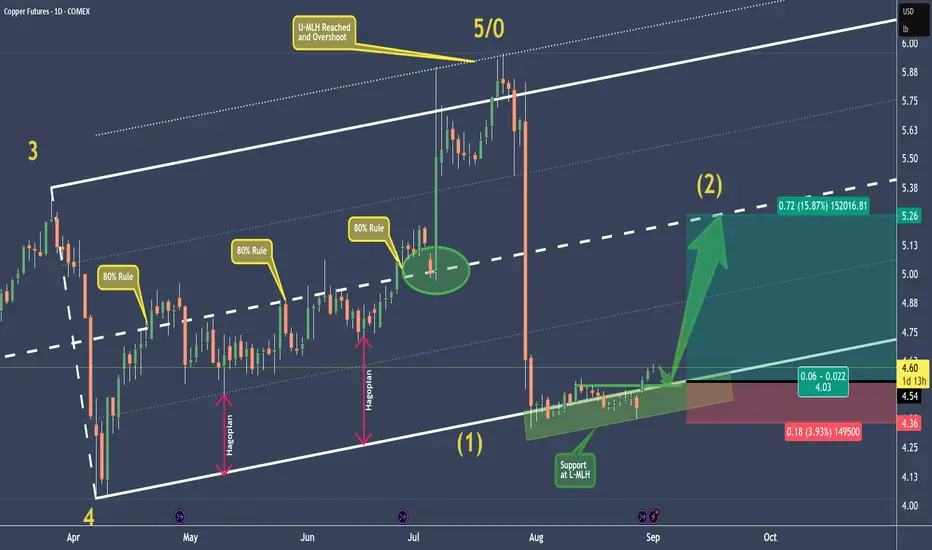

P5/0 at the U-MLH marked the end, and price dropped into the void.

Now, at the L-MLH we see support has built up.

The momentum we see now will probably lead in a pullback before the potential massive run-up to the Centerline.

💡 If the trading God gives me a pullback, I am willingly risk my 0.5% in this trade to make at least 4x more. 🦊

Happy new week to all §8-)

- Short-term: The copper market is turbulent—marked by sharp price spikes, crashes, and global shifts in stock levels.

- Medium-term: Despite forecasted surpluses from ICSG, technology innovations and steady demand (especially from China and green sectors) may underpin prices.

- U.S. risk factor: The tariffs remain a major wildcard, likely restructuring trade flows, increasing domestic input costs, and distorting global price differentials.

📈 Now the Chart:

P5/0 at the U-MLH marked the end, and price dropped into the void.

Now, at the L-MLH we see support has built up.

The momentum we see now will probably lead in a pullback before the potential massive run-up to the Centerline.

💡 If the trading God gives me a pullback, I am willingly risk my 0.5% in this trade to make at least 4x more. 🦊

Happy new week to all §8-)

Nota

Here comes the pullback.If it holds, we are in good shape §8-)

Operación activa

Looks good. Fingers crossed.🔱 FOLLOW & BOOST ME 🔱

✅ Learn to make money

✅ Earn while learning

🔱 All Freebies: howtochart.com/free4you

👉 Detailed Chart Analysis: youtube.com/@howtochart

✅ Learn to make money

✅ Earn while learning

🔱 All Freebies: howtochart.com/free4you

👉 Detailed Chart Analysis: youtube.com/@howtochart

Publicaciones relacionadas

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.

🔱 FOLLOW & BOOST ME 🔱

✅ Learn to make money

✅ Earn while learning

🔱 All Freebies: howtochart.com/free4you

👉 Detailed Chart Analysis: youtube.com/@howtochart

✅ Learn to make money

✅ Earn while learning

🔱 All Freebies: howtochart.com/free4you

👉 Detailed Chart Analysis: youtube.com/@howtochart

Publicaciones relacionadas

Exención de responsabilidad

La información y las publicaciones no constituyen, ni deben considerarse como asesoramiento o recomendaciones financieras, de inversión, de trading o de otro tipo proporcionadas o respaldadas por TradingView. Más información en Condiciones de uso.